What Is A Trust? Refresher and Tax Update

TRUST BASICS

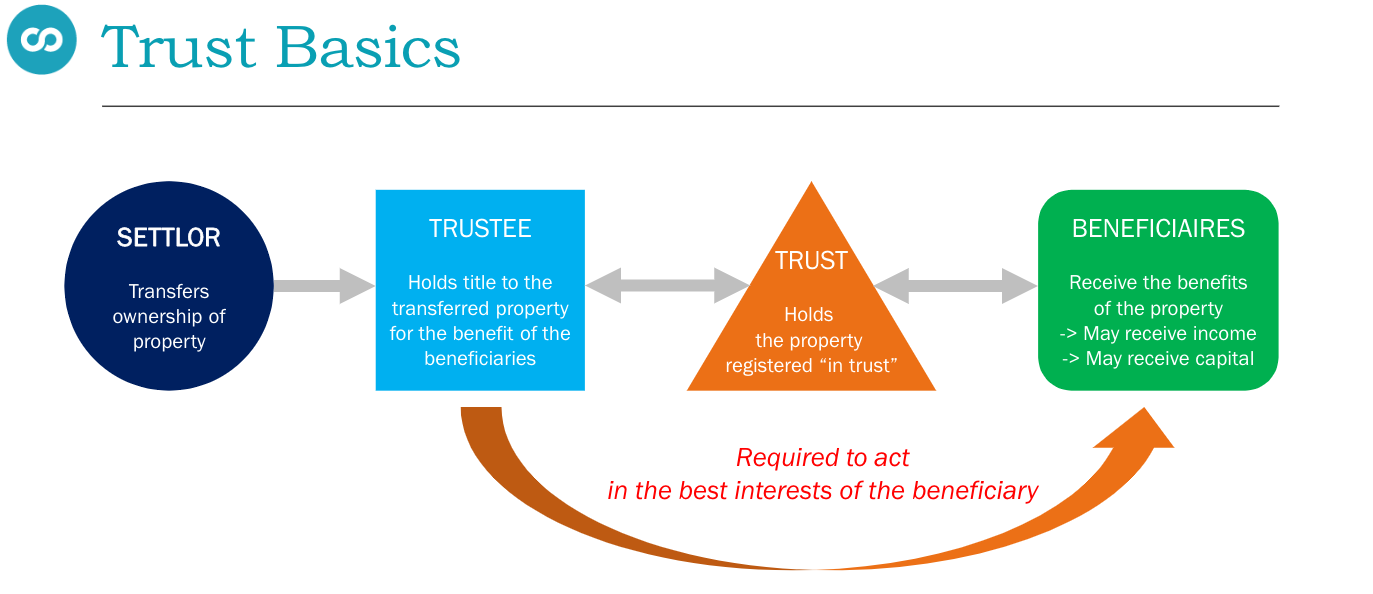

A trust is a legal arrangement established to manage assets for the benefit of designated beneficiaries. It involves three main parties: the settlor, the trustee, and the beneficiary.

The settlor, also known as the grantor or trustor, initiates the trust by transferring assets into it. Once assets are transferred, the settlor relinquishes ownership and control over them.

The trustee, appointed by the settlor, holds legal title to the trust assets and is responsible for managing them in accordance with the terms outlined in the trust deed or agreement.

The beneficiaries are those individuals or entities designated to benefit from the trust assets. They may receive income generated by the trust, have access to trust assets, or both, depending on the terms of the trust.

PARTIES OF A TRUST - THE DETAILS

Settlor

The settlor is the individual who establishes the trust by transferring assets into it. These assets may include cash, real estate, stocks, or other investments. By creating the trust, the settlor effectively removes the assets from their own ownership and control, allowing them to be managed for the benefit of the beneficiaries.

Trustee

The trustee is entrusted with the management and administration of the trust assets. This includes investing the assets prudently, distributing income or capital to beneficiaries as specified in the trust deed, and ensuring compliance with legal and fiduciary obligations. Trustees are required to act in the best interests of the beneficiaries and must adhere to the terms of the trust.

Beneficiary

Beneficiaries are the individuals or entities entitled to benefit from the trust assets. They may receive income generated by the trust, have access to trust property, or both, depending on the terms of the trust. Beneficiaries can be named specifically in the trust deed or identified by class (e.g., children of the settlor).

TYPES OF TRUSTS

Testamentary Trust

A testamentary trust is created through a person's will and comes into effect upon their death. It allows the settlor to specify how their assets should be managed and distributed after their passing, providing ongoing financial support and protection for beneficiaries.

Inter Vivos Trust (Living Trust)

An inter vivos trust is established during the settlor's lifetime. It allows the settlor to transfer assets into the trust while retaining control over them until specified conditions are met or upon their death. Living trusts are commonly used for estate planning, asset protection, and tax efficiency purposes.

Examples of an Inter Vivos trust include family trusts and bare trusts.

COMPLIANCE INFORMATION

A trust is deemed to be an individual and a taxpayer separate and distinct from its trustees and beneficiaries.

Each trust must file an annual T3 Trust Income Tax and Information Return.

The T3 return (and all relevant T3 slips) must be filed within 90 days from the end of the trust’s taxation year - which is typically due by March 31 (but accelerated to March 30 for leap years).

For years ending before December 30, 2023, trusts generally were not required to file unless:

There is tax payable in the year

The trust has disposed of capital property during the year

The trust was deemed resident trust; or

The trust received income or gain and allocated it to one of the beneficiaries

Many dormant trusts did not have to file.

For year ending on or after December 31, 2023, it is no mandatory to disclose:

Name

Address

Date of birth

Jurisdiction of residence; and

SIN

Of each settlor, trustee, beneficiary, and any person who has the ability to exert influence over trustee decisions regarding the appointment of income or capital of the trust.

INCOME TAX BENEFITS OF TRUSTS

Income Splitting

Trusts can facilitate income splitting by distributing income to beneficiaries in lower tax brackets. This can result in overall tax savings for the family unit, as income taxed at lower rates may reduce the total tax liability.

Estate Planning

Trusts can play a crucial role in estate planning by allowing individuals to specify how their assets should be managed and distributed after their death. By creating a trust, individuals can ensure that their assets are distributed according to their wishes, minimize probate fees and estate taxes, and provide ongoing financial support for beneficiaries.

Asset Protection

Trusts can offer asset protection benefits by shielding assets from creditors, lawsuits, and other claims. By transferring assets into a trust, individuals can safeguard their wealth against potential risks and ensure that it is preserved for the benefit of themselves and their beneficiaries.

MULTIPLICATION OF THE CAPITAL GAINS EXEMPTION

In Canada, the multiplication of the capital gains exemption (CGE) by beneficiaries of a trust refers to a tax planning strategy that allows multiple beneficiaries of a trust to utilize their individual lifetime CGE limits when disposing of qualified small business corporation (QSBC).

When assets eligible for the CGE are held within a trust, each beneficiary of the trust may potentially qualify to claim their individual CGE limit upon the disposition of their share of the trust assets. This means that if there are multiple beneficiaries of the trust, each beneficiary may be able to shelter a portion of the capital gains realized on the sale of their allocated share of the trust assets using their CGE limit.

By distributing the trust assets among multiple beneficiaries and structuring the trust appropriately, individuals can effectively multiply the CGE and potentially realize significant tax savings on the disposition of QSBC shares

However, it's essential to note that the multiplication of the CGE by beneficiaries of a trust involves complex tax rules and regulations, and the availability of this tax planning strategy may depend on various factors, including the specific terms of the trust, the nature of the trust assets, and the individual circumstances of the beneficiaries.

At ConnectCPA we can handle the implementation of trusts and the tax planning that goes along with it - please contact us to have a discussion about potential tax strategies that may benefit you.

FINAL THOUGHTS

Overall, trusts can be powerful tools for achieving various financial and estate planning objectives, but their effectiveness depends on individual circumstances and careful consideration of tax implications and legal requirements. Consulting with a tax professional or estate planner is essential to determine the most suitable trust structure and strategy for your specific needs.