9 Lesser Known Tax Deductions, Expenses and Tax Tips

There are lots of online tax articles and blog posts that provide amazing information but cover typical and common expenses and their associated tax implications. What about lesser known deductions and accounting tips?

Don’t they deserve some tax love too?

After being intimately involved in the day-to-day bookkeeping and accounting function for hundreds of clients, our team came up with a list of what we thought were ‘lesser known tax items’ that we’ve encountered along the way. We’ve listed them below - hopefully you get some use out of them.

If you think we missed some good ones, please add a comment so that it can be shared with other readers.

FYI #1: “Expenses” and “Deductions” are all used interchangeably in this post. They represent the costs that a business incurs.

FYI #2: If you file GST/HST based on the ‘Quick Method’, most if not all of the below will not apply to you. That said, we find that only a small percentage of businesses use the ‘Quick Method’ for sales tax filings.

*** The information provided in this post, including any tax information, is general information only and does not constitute advice. It has been prepared without taking into account any company objectives or tax and financial circumstances. ***

1. GST/HST ON PARKING RECEIPTS (NOT PARKING TICKETS)

Firstly, why is this important?

As a GST/HST registrant, your company is allowed to claim back any GST or HST you incur on expenses (it’s called an ‘Input Tax Credit’ or ITC). Any sales tax you incur reduces any sales tax you have collected and owe. This is a big deal because ITC’s can significantly assist with cash flow. And if you are a GST/HST registrant but don’t collect GST or HST, you can still claim back your ITC’s through refunds (also a big deal).

Back to the topic at hand.

Whether it’s for meetings, meals or conferences, vehicle parking is an extremely common expense. One lesser known fact about parking is that the sales tax component (GST/HST) is included in the expense. Many receipts neglect to mention it.

Most other receipts always have a breakdown of the subtotal (expense) and the sales tax (GST or HST) associated with it, but with parking, it is common to see neither (you’ll just see the total - refer to image below).

You should start treating all parking receipts as GST or HST inclusive and if you missed any in the past, most businesses can retroactively calculate the missed ITC’s and add them to their next sales tax filing, so long as the missed ITC’s occurred no more than 4 years prior (more on this below - tip #9).

2. GST/HST on TAXI OR RIDE-SHARING FARES (UBER, LYFT, ETC.)

Similar to our parking example above, sales tax is included in the taxi fares. Taxis and Uber do a better job than parking facilities do when it comes to being transparent and showing you the breakdown of the overall fee. If you do come across a receipt that doesn’t break down the sales tax amount, rest assured, in most cases, you are able to claim the ITC associated with the fare - you just have to know how to calculate it.

HOW TO CALCULATE GST/HST INCLUDED IN AN EXPENSE

To determine the amount of GST included in your fare, multiply the total by 5 and divide the result by 105.

To determine the amount of HST included in your fare:

for 13% HST, multiply the total fare by 13 and divide the result by 113

for 15% HST, multiply the total fare by 15 and divide the result by 115

3. GST/HST ON MILEAGE REIMBURSEMENTS

For businesses with employees that travel by vehicle and receive reasonable reimbursements for the mileage driven, be aware that similar to our examples above, you can claim an imputed ITC based on the reimbursement. You would use the same formula we used above to calculate the GST or HST included in the mileage reimbursement.

For example, based on CRA’s mileage reimbursement guidelines, let’s say an employee in Ontario submitted a mileage reimbursement claim of $100:

The employer pays the employee $100

Of the $100, $11.50 is an ITC and can be claimed on a sales tax filing, thereby reducing their sales tax balance by $11.50 (or receiving a refund for $11.50) - calculated as $100 X 13 ÷ 113.

The actual ‘travel’ or ‘mileage’ expense for your accounting records is $88.50 ($100 less $11.50)

4. GST/HST ON REIMBURSEMENTS/RE-BILLABLE EXPENSES

There are many rules surrounding this topic and it can get quite complicated, therefore we will stick with a basic example. For any situations that are not clearly defined, please reach out to a tax expert.

Suppose you incur expenses on a project that you will be re-billing to a client. When an expense includes sales tax and you’re in the same province as your client, you just re-bill the subtotal + sales tax (i.e. identical to your outlay). For example, let’s say you incurred a hotel expense in Vancouver for $100 + GST of 5% ($5), for a total of $105. In this scenario, your expense is $100 and your ITC is $5. You would then re-bill your client the same amount: $100 in income or re-billable expense + 5% GST ($5) =$105. In this example you incurred $5 in GST (which you can claim back) but you also collected $5 in GST when you re-billed the client. Everything nets to zero, which makes sense.

More complicated situations arise when expenses are not taxable or when geography comes into play.

Example #1

Your company incurred an expense that is not taxable (let’s say insurance) and it is re-billed to a client in the same province.

Even though the source transaction did not include GST or HST, you would still need to charge GST or HST to your client. In this example, you did not claim an ITC but you collected GST or HST when you re-billed the client.

Example #2

Suppose your company incurred GST or HST on an expense but the client is a non-resident of Canada (i.e. a non-Canadian business).

The basic rule of thumb is that you don’t charge GST/HST on any revenue-generating activities to businesses outside of Canada. The same holds true here.

In this example, say you incurred a $100 hotel charge + 15% HST in Halifax = $115. Your true expense is $100 and your ITC is $15. When you re-bill the client, you would charge them $115 (no GST or HST since they are not Canadian). In this example, you claimed an ITC but did not collect any GST or HST.

Caveat: As mentioned, this issue can get complex, especially if you are acting as an ‘Agent’ (i.e. where the expense incurred was directly on behalf of the client). This goes beyond the scope of this post but you can find more information here.

5. DAY-TO-DAY EXPENSES THAT ARE NOT GST/HST TAXABLE

Interest charges

Bank and credit card transaction fees

Insurance fees

Software fees from US vendors (note: some US vendors have a Canadian entity and charge sales tax, even in USD)

The expenses above, in most cases, should be recorded without sales tax.

6. CHARGING SALES TAX FROM CANADIAN ENTITIES TO NON-CANADIAN ENTITIES

We often come across this question: “Do I need to charge GST or HST to my client in the United States?”

The answer, most often, is No.

There are exceptions to the rule - if the US entity has a Canadian sales tax registration for example - but that goes beyond the scope of this post.

A rule of the thumb is that you don’t charge sales tax (GST or HST) to any entities outside of Canada (USA, Overseas companies, etc.).

We usually then receive this follow-up question: “I’m not charging or collecting GST/HST since all my customers are in the US. But I have lots of ITC’s (GST/HST applicable expenses in Canada) - can I claim those?”

The answer is Yes. Your sales tax filing will be in a refund position, and if accurate (and you have all the supporting documentation), the CRA will send funds your way.

When your GST/HST filing is in a refund position, you can at one point expect to receive a templated letter from the CRA asking for supporting documentation. They want to ensure that the refund is accurate and was not calculated or filed in error.

7. COMPANY SOCIAL EVENT EXPENSES

It is common knowledge that meals and entertainment expenses are 50% deductible.

A lesser known deduction is related to company social events. If a company provides a party or social event to all employees or all employees from a specific location (they don’t all have to attend, they just need to be invited), then the full cost of the event is deductible.

Caveat: There is a limit of 6 events per year that are fully deductible.

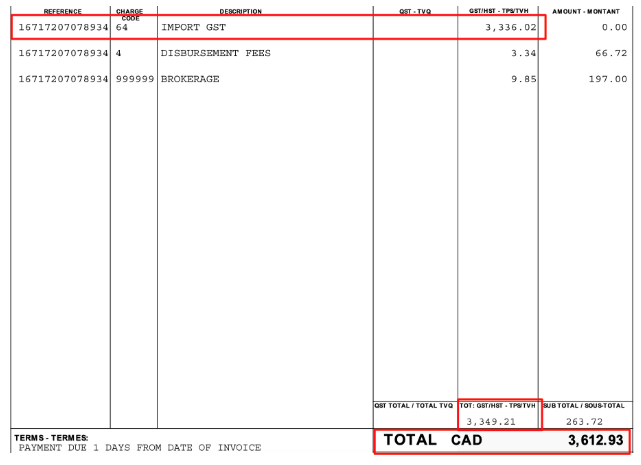

8. IMPORT DUTIES

Companies that import tangible goods from outside of Canada for commercial use (i.e. import goods for resale) need to still pay sales tax on the imported goods.

This is another one of thoses topics that can get complex based on the circumstances, but at the most basic level, the sales tax paid to receive these goods is an ITC.

Many companies use a customs broker service to coordinate receipt of shipments. They (the broker) may front the sales tax and then pass along the charge to you through an invoice. Other times they will let you know the amount of sales tax owing and you’ll have to remit payment immediately. The sales tax amount can be significant.

We have seen many examples where these amounts have been coded to an expense (i.e. Broker fees, Cost of Goods, etc.) or inventory. This is incorrect and can cost a company significantly. It can get confusing because the invoice total mostly represents the full sales tax charge rather than what companies are used to seeing (sales tax being a small percentage of the invoice).

For example, you’ll see from the image below that the total invoice is $3,612.93. Of this amount, $3,349.21 (92.7 % of the total) is an ITC and would be claimed on a subsequent GST/HST sales tax filing.

9. PREVIOUSLY UNCLAIMED ITC’S ON CURRENT SALES TAX FILINGS

If you realize that your company or the company you work for has left ITC’s on the table (i.e. never been included in a sales tax filing), then fear not, most GST/HST registered companies have 4 years to claim their ITC’s. There is a 2 year limit for larger businesses (over $6 million in revenue) and certain financial institutions.

This is great news.

We’ve personally witnessed significant unclaimed ITC’s from previous years that we have been able to claim on current sales tax filings, resulting in increased cash-flow and happy customers.

FINAL THOUGHTS

We hope this list was informative. If you have other examples of lesser known tax deductions and/or tips, feel free to add a comment and share with others!

Reminder: The information provided in this post, including any tax information, is general information only and does not constitute advice. It has been prepared without taking into account any company objectives or tax and financial circumstances.