COVID-19: Canada Emergency Rent Subsidy (CERS) Breakdown and Example

On November 23, 2020, the Canadian government officially announced details of the long-awaited Canada Emergency Rent Subsidy (CERS) program. This program was introduced in order to provide rent relief for both tenants and property owners.

The basic mechanism to determine the subsidy amount is very similar to the existing Canada Emergency Wage Subsidy (CEWS) program. For businesses that have suffered a revenue drop, the subsidy amount will be determined by the percentage of their eligible expenses on a sliding scale.

This program differs significantly from the previous rental subsidy program - The Canada Emergency Commercial Rent Assistance (CECRA) - since tenants do not need their landlords to apply on their behalf.

Please see below for a summary of the CERS program and the application process:

WHO IS ELIGIBLE?

You must meet ALL FOUR of the following criteria in order to qualify:

Meet at least one of the following:

You had a CRA business number on September 27, 2020

You had a payroll account on March 15, 2020, OR another person or partnership made payroll remittances on your behalf

You purchased the business assets of another person or partnership who meets the above two conditions and have made an election under the special asset acquisition rules

You meet any other future conditions (not introduced yet)

You fall under one of the following entities:

Individuals

Corporations that are not exempted from income tax

Registered charities

Partnership

You had a drop in revenue

You have eligible expenses

ELIGIBLE PERIODS

Currently, the government has announced the following three periods for which CERS can be applied for. Announcements related to future periods will follow:

Period 1 - September 27, 2020 - October 24, 2020

Period 2 - October 25, 2020 - November 21, 2020

Period 3 - November 22, 2020 - December 19, 2020

ELIGIBLE EXPENSES

The following expenses are eligible for the CERS Subsidy. Please note that any payments between non-arm’s length entities or payments outside the claim period are NOT eligible.

The maximum eligible expense per location: $75,000

The maximum total eligible expense for all locations: $300,000. This includes the amounts claimed by affiliated businesses

If you rent a property, the eligible expenses will include:

Base rent

Property taxes paid by the renter

Regular customary ancillary services or operating expenses payment

If you own the property, the eligible expenses will include:

Property taxes

Property insurance

Interest on mortgage

Please note that the following expense are NOT eligible expenses:

GST/HST related to the eligible expenses

Expenses that relate to residential property used by the taxpayer (i.e. house, cottage)

Payments between non-arm’s length entities

Mortgage interest expense related to property primarily used to earn rental income

SUBSIDY CALCULATION

The subsidy calculation is comprised of two components:

Rent subsidy

Lockdown support top-up (to be added to the subsidy)

1. Rent Subsidy

There are two ways to calculate the revenue drop in order to check your eligibility.

Compare the corresponding month of 2019:

You are checking revenue difference for the period from September 27, 2020 - October 24, 2020 and September 2019 and October 2019

Compare with January and February 2020 revenue

You are checking revenue difference for the period from September 27, 2020 - October 24, 2020 and the average of revenue from January 1, 2020 - February 29, 2020

IMPORTANT: You must use the same option for all future CERS claims. If you have also claimed the CEWS, you must use the same method you used for the base CEWS for periods 5 or later.

Subsidy thresholds:

Lockdown top-up

You may also qualify for ‘lockdown top-up’ support amount for locations affected by public health restrictions. This amount is added to your subsidy rate. The calculation is as follows:

25% x # of days lockdown / # of days in CERS period

For example: A store was locked down for 14 days due to a government shutdown order. The lockdown top-up is 25% x 14 days / 28 days = 12.5%

EXAMPLE USING JANUARY AND FEBRUARY 2020 AVERAGE REVENUE BASELINE

ABC Inc. earned a revenue of $100,000 in September 2020 and $110,000 in October 2020 and had an eligible rent expense of $2,000 each month. The company had an average revenue of $210,000 for January - February 2020. Therefore, ABC Inc. saw a revenue decline of 52.38% and 47.62% in September and October. Since the 52.38% drop is higher, this rate will be used as the subsidy rate

Since the revenue drop is between 50% - 70%, the subsidy rate is as follows:

(52.38% - 50%) x 1.25 + 40% = 42.98%

During this time, ABC Inc. was forced to shut down its location for a full period (28 days) due to a government-imposed shutdown. Therefore, ABC Inc. is eligible for lockdown top-up as follows:

25% x 28 days / 28 total days = 25%

The total rent subsidy ABC Inc. is entitled to for the period is $1,233.87, which is made up of $780.11 (rent subsidy) and $453.76 (lockdown support). The numbers above use the $2,000 per month rent amount, pro-rated for 28 days that spans September 2020 and October 2020.

HOW TO APPLY?

You can apply by logging into the following Canada Revenue Agency (CRA) services:

My Business Account OR;

Represent a Client (i.e. through an authorized third-party - usually an accountant)

Prior to submitting a CERS application, you must complete and sign an RC665 - Canada Emergency Rent Subsidy Attestation.

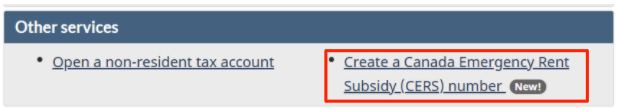

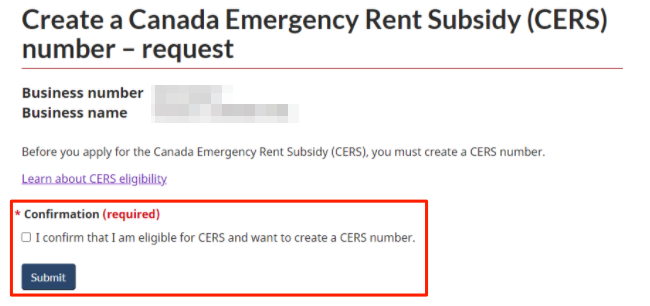

You must also ensure that you register for a CRA CERS number. The registration can be done under the ‘Other services’ section upon logging into the ‘My Business Account’.

After submitting THE request, a new ‘ZA0001’ account will appear to confirm that you are registered for a CERS number.

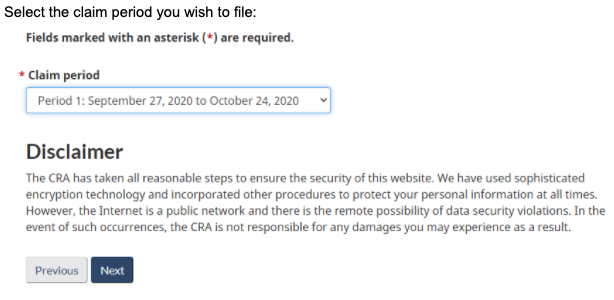

To submit a CERS application, you would have to pick the corresponding period and fill in the required information. It’s somewhat straightforward but it may be worthwhile to speak to an accountant, especially if CEWS was filed for you already, as you will need to use the same criteria (noted above).

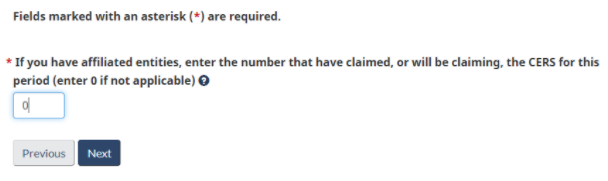

Enter the numbers of any affiliated entities. If there are no affiliated entities, enter ‘0’:

Fill out the information:

Enter the eligible rent and revenue drop percentages. Enter lockdown support top-up amount if you are eligible:

At the end of the application, you’ll need to confirm and review the calculation and information. Fill out the contact information of the submitter and click on ‘Submit’ to finalize the application.

FINAL THOUGHTS

Under CERS, tenants are able to directly apply and receive funds without the involvement of their landlords. CERS also provides a sliding scale threshold, which allows tenants who did not meet CECRA’s high threshold to be eligible for the rent relief. Overall, CERS does address many challenges that the CECRA program faced, which includes lack of accessibility for the tenants and heavy onus placed on the landlords.